Colon Hydrotherapy Device Manufacturer

Financing Options for Colon Hydrotherapy Machine

October 11, 2025

Understanding the Investment in Colon Hydrotherapy Machines

Before exploring financing options, it’s important to understand the total investment required for a professional colon hydrotherapy machine. The initial purchase is just one component of the overall cost structure.

| Cost Component | Typical Range | Considerations |

| Equipment Purchase | $3,200 – $4,900 | Entry-level vs. advanced models with additional features |

| Installation | $200 – $500 | Plumbing requirements, electrical setup |

| Training | $300 – $800 | Staff certification, operational training |

| Disposable Supplies | $5 – $15 per session | Recurring cost, bulk purchasing options |

| Maintenance | $200 – $400 annually | Service contracts, warranty coverage |

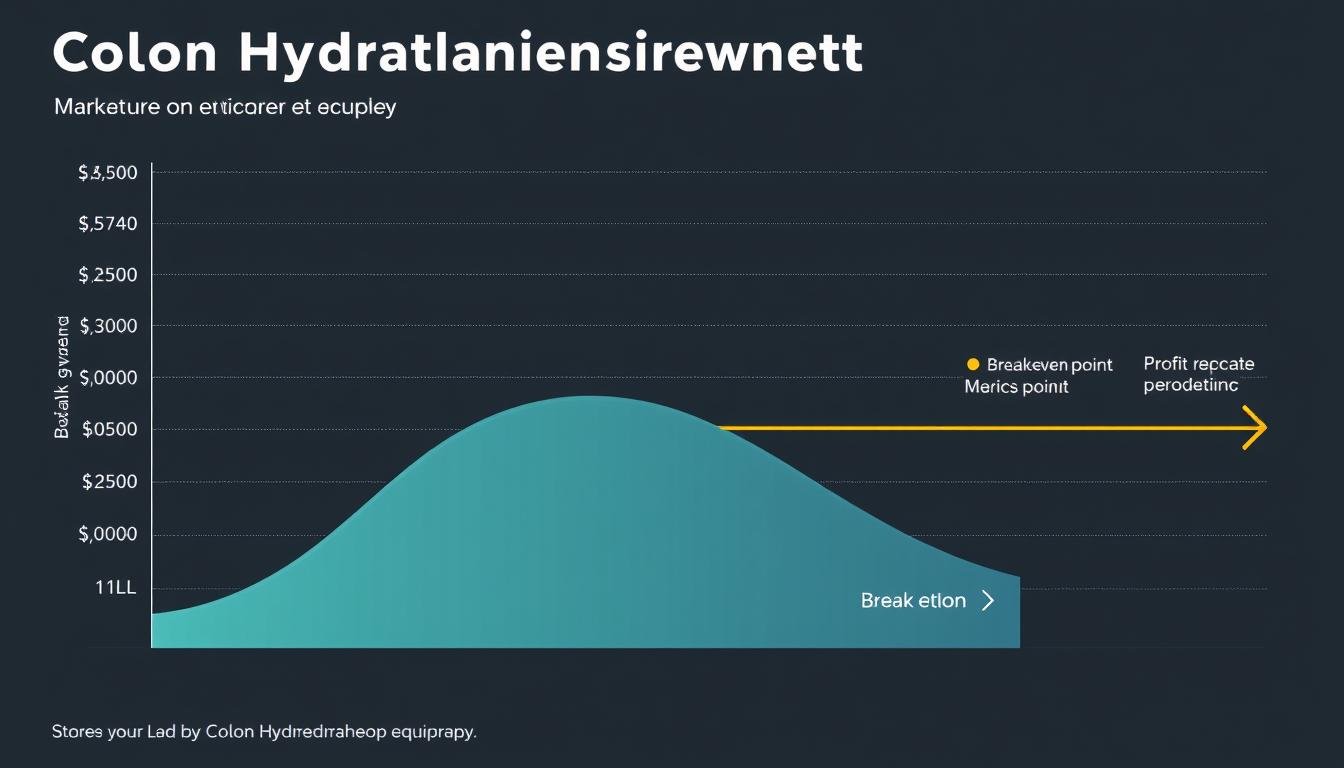

Understanding these costs helps determine the total financing needed and evaluate the return on investment timeline. Most practitioners can expect to recoup their investment within 6-18 months, depending on session pricing and client volume.

5 Primary Financing Methods for Colon Hydrotherapy Equipment

There are several approaches to financing your colon hydrotherapy machine, each with distinct advantages and considerations. Let’s explore the most common options available to medical and wellness professionals.

1. Equipment Leasing

Advantages

- Lower initial cash outlay

- Fixed monthly payments for easier budgeting

- Potential tax advantages (consult your accountant)

- Option to upgrade equipment at end of lease term

- May include maintenance coverage

Disadvantages

- Higher total cost over the full term

- Contractual obligation for the entire lease period

- May require good business credit history

- No ownership equity until lease completion (if purchase option)

- Potential early termination penalties

Equipment leasing typically involves monthly payments over 24-60 months with options to purchase, return, or upgrade at the end of the term. This approach is ideal for practices that prefer predictable payments and plan to upgrade equipment regularly.

2. Medical Equipment Loans

Advantages

- Build equity in the equipment from day one

- Ownership at loan completion

- Potential interest deductions for tax purposes

- Flexible loan terms (typically 1-7 years)

- No restrictions on equipment use or modifications

Disadvantages

- May require down payment (10-20%)

- Responsible for all maintenance and repairs

- Depreciation of owned equipment

- Potentially higher monthly payments than leasing

- Stricter credit requirements from traditional lenders

Medical equipment loans provide immediate ownership while spreading payments over time. This option is best for established practices with good credit that plan to keep the equipment long-term and want to build equity.

3. Manufacturer Financing Programs

Advantages

- Often includes installation and training

- Simplified application process

- Potential for promotional rates or deferred payments

- Bundled warranty and service packages

- Relationship with manufacturer for future support

Disadvantages

- Limited to specific equipment brands

- May have higher interest rates after promotional period

- Less flexibility in negotiating terms

- Potential for upselling unnecessary features

- May require exclusive service agreements

Many colon hydrotherapy machine manufacturers offer their own financing programs, often with promotional terms for qualified buyers. This option provides convenience and potentially favorable initial terms, especially for new practices.

4. Healthcare-Specific Lenders

Advantages

- Specialized understanding of medical equipment value

- More flexible qualification criteria

- Tailored payment structures for healthcare businesses

- Faster approval process than traditional banks

- May finance additional costs (training, supplies)

Disadvantages

- Potentially higher interest rates than traditional loans

- May require industry-specific documentation

- Shorter loan terms in some cases

- Less regulated than traditional banking options

- Variable reputation and service quality

Healthcare-specific lenders specialize in medical equipment financing and understand the unique needs of wellness practices. These lenders often approve applications that traditional banks might decline, making them suitable for newer practices or those with limited credit history.

5. Business Line of Credit

Advantages

- Flexibility to use funds for equipment and other expenses

- Pay interest only on the amount used

- Revolving credit – borrow again as you repay

- No reapplication for additional purchases

- Potential for negotiable interest rates

Disadvantages

- Typically higher interest rates than dedicated loans

- May require strong business credit history

- Potential for variable interest rates

- Credit limit may be insufficient for full equipment cost

- Temptation to use credit for non-essential expenses

A business line of credit provides flexible access to funds that can be used for purchasing equipment and managing other business expenses. This option works well for established practices with strong credit that need financing flexibility.

Need Help Finding the Right Financing Option?

Our financing specialists can help you navigate the available options and find the solution that best fits your practice’s needs and financial situation.

Choosing the Best Financing Plan for Your Colon Hydrotherapy Machine

Selecting the optimal financing approach depends on your business situation, credit profile, cash flow needs, and long-term equipment plans. The following comparison can help you evaluate which option aligns best with your requirements.

| Financing Method | Best For | Typical Terms | Approval Difficulty | Ownership |

| Equipment Leasing | Practices wanting low monthly payments and regular upgrades | 24-60 months, 0-10% down | Moderate | Optional at end of term |

| Medical Equipment Loans | Established practices planning long-term equipment use | 1-7 years, 10-20% down | Moderate-High | Immediate |

| Manufacturer Financing | New practices seeking bundled solutions | 36-60 months, promotional rates | Moderate | Varies by program |

| Healthcare Lenders | Practices with limited credit history | 2-5 years, flexible down payment | Low-Moderate | Immediate |

| Business Line of Credit | Established practices needing financing flexibility | Revolving, variable rates | High | Immediate |

Key Factors to Consider When Choosing Financing

- Total cost of ownership (including interest and fees)

- Monthly payment amount and impact on cash flow

- Length of financing term vs. expected equipment lifespan

- Tax implications of different financing methods

- Flexibility to upgrade or modify equipment

- Early payoff options and potential penalties

- Warranty coverage and maintenance responsibilities

- Application requirements and approval timeline

Pro Tip: Request a complete amortization schedule for any financing option you’re considering. This will show the full payment breakdown over time and help you understand the true cost of financing.

Industry Statistics: Financing Colon Hydrotherapy Machines

Understanding industry benchmarks can help you evaluate financing offers and make informed decisions. Here are key statistics regarding medical equipment financing in the wellness sector:

Average Equipment Cost

Professional colon hydrotherapy machines typically range from $3,200 to $4,900, with premium models reaching $6,000+.

Typical Financing Terms

Most equipment financing arrangements have terms of 36-60 months, with interest rates ranging from 5-15% depending on credit profile.

Approval Rates

Approximately 65-75% of medical equipment financing applications are approved, with higher rates for established practices.

These statistics indicate that with proper financing and business planning, a colon hydrotherapy machine can be a financially viable investment for wellness practices, typically paying for itself within the first year of operation.

Navigating the Financing Application Process

Securing financing for your colon hydrotherapy machine involves several steps. Being prepared with the right documentation can streamline the process and improve your chances of approval.

Required Documentation

- Business license and registration

- 2+ years of business tax returns

- Personal tax returns for owners

- Bank statements (last 3-6 months)

- Equipment quote or invoice

- Business plan (for newer practices)

- Financial statements (P&L, balance sheet)

Application Timeline

- Pre-qualification: 1-2 days

- Document submission: 1-3 days

- Underwriting review: 2-5 days

- Approval decision: 1-2 days

- Contract preparation: 1-2 days

- Funding disbursement: 1-3 days

- Total process: 7-17 days

Improving Approval Odds

- Maintain good personal credit (680+)

- Establish business credit accounts

- Prepare detailed business plan

- Demonstrate stable cash flow

- Offer larger down payment

- Consider a cosigner if needed

- Work with specialized healthcare lenders

“The key to successful equipment financing is preparation. Having your financial documentation organized and understanding your business metrics before applying can significantly improve your approval chances and help secure better terms.”

Frequently Asked Questions About Colon Hydrotherapy Machine Financing

What credit score is needed to finance a colon hydrotherapy machine?

Most lenders prefer a personal credit score of 650+ for primary applicants. However, healthcare-specific lenders may approve applications with scores as low as 600 if other business metrics are strong. For the most favorable rates, aim for a score of 700+. If your credit score is lower, consider offering a larger down payment or securing a cosigner.

Can new practices qualify for equipment financing?

Yes, new practices can qualify for financing, though terms may be less favorable than for established businesses. Lenders typically look for at least 6-12 months of operational history. New practices should prepare a comprehensive business plan, demonstrate industry experience, and be prepared for a larger down payment (20-30%). Manufacturer financing programs and healthcare-specific lenders often have special programs for new practices.

Is it better to lease or purchase a colon hydrotherapy machine?

The decision depends on your specific business situation:

- Leasing is better if: You prefer lower monthly payments, want to upgrade equipment regularly (every 3-5 years), or want to preserve working capital for other business needs.

- Purchasing is better if: You plan to keep the equipment long-term (5+ years), want to build equity, or prefer the tax advantages of ownership (Section 179 deduction, depreciation).

Consult with your accountant to understand the tax implications for your specific situation.

What happens if I need to upgrade my equipment before the financing term ends?

Options vary based on your financing arrangement:

- With leasing: Many leases offer equipment upgrade options after a certain period (typically 24-36 months). The remaining lease obligation is often rolled into a new lease for upgraded equipment.

- With loans: You’ll need to either pay off the existing loan before upgrading or sell the equipment and use the proceeds toward the loan balance. Some lenders offer refinancing options that combine the remaining balance with financing for new equipment.

Review your financing agreement carefully and discuss upgrade options with your lender before signing.

Are there tax advantages to financing a colon hydrotherapy machine?

Yes, there are potential tax advantages depending on the financing method:

- Equipment loans: May qualify for Section 179 deduction, allowing you to deduct the full purchase price in the year acquired (subject to limits). You may also claim depreciation over the equipment’s useful life.

- Equipment leases: Monthly lease payments may be fully tax-deductible as business expenses for operating leases. Capital leases have different tax treatments similar to loans.

Always consult with a qualified tax professional to understand the current tax implications for your specific business structure and financing arrangement.

Get Personalized Financing Solutions for Your Colon Hydrotherapy Machine

Navigating the various financing options for medical equipment can be complex. Our financing specialists are ready to help you explore solutions tailored to your practice’s specific needs and financial situation.

Contact Our Financing Team

Reach out today to discuss your options for financing a colon hydrotherapy machine. We’ll help you find the solution that best fits your business goals and budget.

WhatsApp: +86 13-51090-74-01

Making the Right Financing Decision for Your Practice

Investing in a colon hydrotherapy machine is a significant decision that can enhance your practice’s service offerings and revenue potential. By carefully evaluating the financing options available and selecting the approach that aligns with your business goals and financial situation, you can acquire this valuable equipment while maintaining healthy cash flow.

Remember that the right financing solution varies based on your specific circumstances, including your practice’s age, credit profile, cash flow, and long-term equipment plans. Taking the time to explore multiple options and consulting with financing specialists can help ensure you make the most advantageous choice for your business.

Ready to Take the Next Step?

Contact our team today to discuss your colon hydrotherapy machine financing needs and receive personalized guidance on the best options for your practice.

Contact us By WhatsApp: